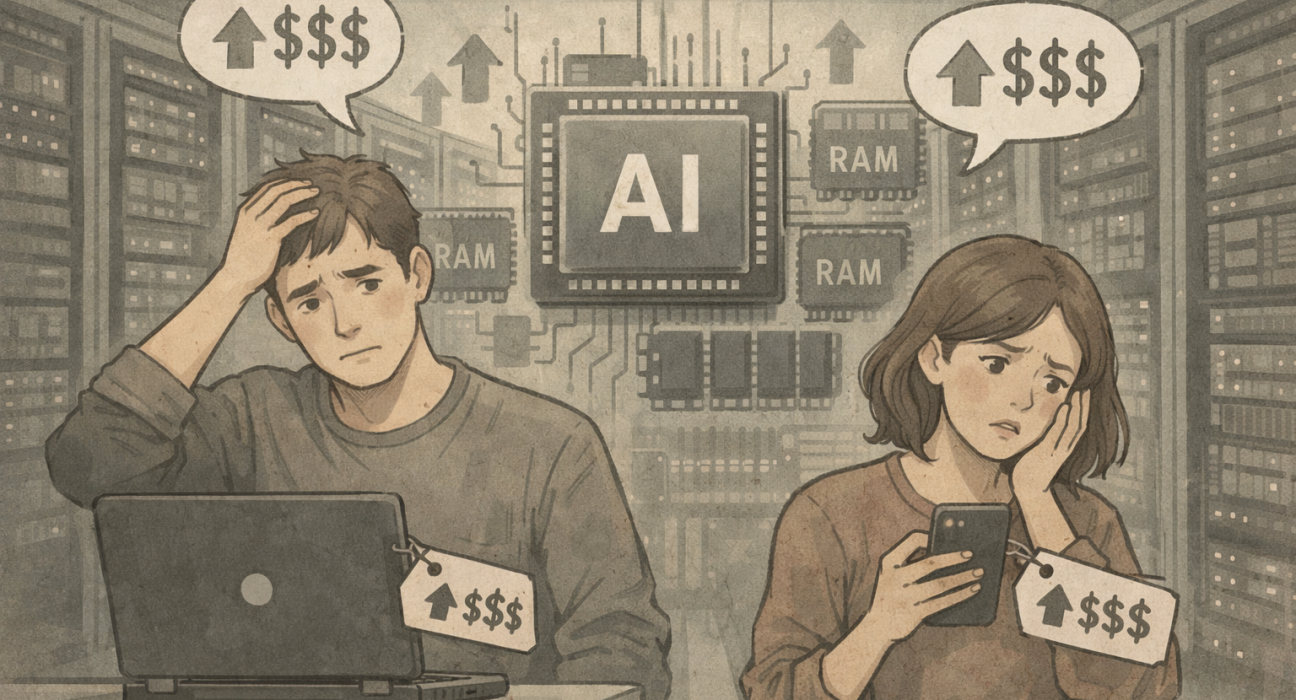

From IndiGo seats to your phone bill: who is profiting as Indian markets concentrate

When a single airline carries nearly two-thirds of India’s domestic passengers and two apps handle more than four out of every five UPI transactions, market dominance is no longer an abstract policy; it becomes a monthly line item on your bill. India’s economy has quietly consolidated into oligopolies across essential services. IndiGo’s December 2025 operational